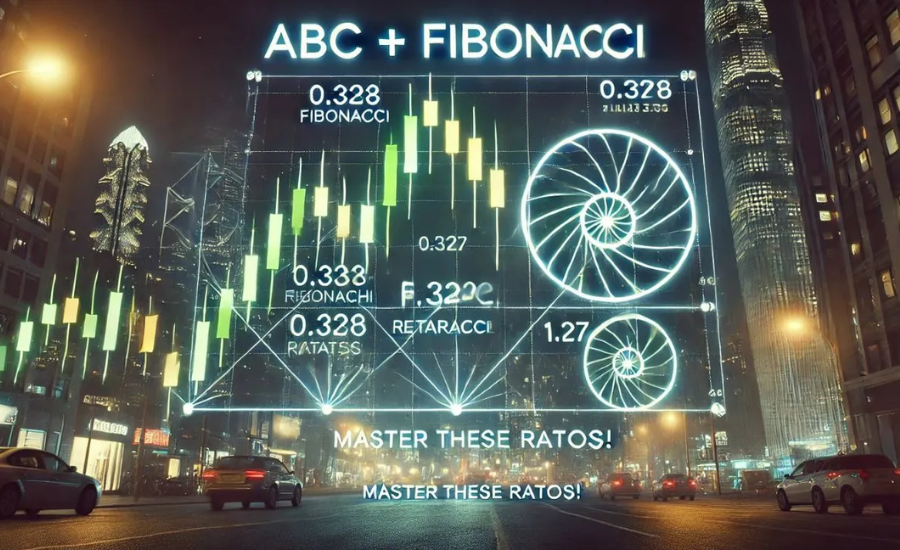

In the dynamic world of trading, making well-informed decisions is crucial for optimizing gains. One of the widely recognized patterns that traders rely on is the Abc pattern .328 1.27, valued for its simplicity and ability to forecast market trends. Its ease of use has made it popular, especially when combined with Fibonacci retracement levels, such as the .328 and 1.27 ratios.

The Abc pattern .328 1.27 is defined by three significant points: A, B, and C. The movement from point A to point B represents an initial price action, followed by a corrective phase that moves from point B to point C. This structure offers insight into possible trend reversals, helping traders predict potential market shifts.

Incorporating Fibonacci ratios adds depth to the analysis. The .328 ratio often acts as a critical support level during market corrections, signaling a possible bounce-back in prices. On the other hand, the 1.27 Fibonacci extension serves as a common target for taking profits. By identifying these key levels within the Abc pattern .328 1.27, traders can refine their strategies and improve decision-making.

Mastering the Abc pattern .328 1.27 and leveraging Fibonacci levels can give traders an edge, allowing them to navigate market volatility with increased confidence and accuracy.

What Is The Abc pattern .328 1.27?

The Abc pattern .328 1.27 (.328 1.27) is a widely recognized trading formation that helps traders identify potential price reversals. It consists of three key points: A, B, and C. Each point reflects crucial price levels that can guide decision-making.

- Point A: This marks either the starting high or low of a trend.

- Point B: From here, prices experience a retracement or correction, indicating a pause in the market’s movement.

- Point C: This represents a final price shift, which may signal either a continuation or reversal of the original trend.

Traders closely watch for the Abc pattern .328 1.27 because it helps pinpoint ideal entry and exit points for their trades. Identifying this structure provides a more calculated approach to market behavior, reducing the emotional component that can often cloud judgment.

Pairing the Abc pattern .328 1.27 with Fibonacci ratios further improves its predictive value. The interplay between these elements allows traders to better understand market support and resistance levels, enhancing the accuracy of their strategies.

The History Of Fibonacci Ratios

The origins of Fibonacci ratios date back to the 13th century when Italian mathematician Leonardo Fibonacci introduced them through his groundbreaking work, Liber Abaci. This text revealed the now-famous Fibonacci sequence, where each number is the sum of the two preceding ones, starting with 0 and 1.

Fibonacci’s sequence is found not just in mathematics but throughout nature—in the arrangement of flower petals, the spirals of pinecones, and the curves of seashells.

As traders explored financial markets, they recognized how Fibonacci ratios could be applied to price movements. These ratios—such as .618 (the golden ratio), .382, and .236—became valuable tools for identifying key retracement and extension levels within market trends.

Over time, Fibonacci-based analysis has become a fundamental component of technical analysis, offering traders deeper insights into price action by highlighting natural patterns that influence market dynamics.

Fibonacci Ratios: A Cornerstone In Trading

Leonardo of Pisa, famously known as Fibonacci, introduced a sequence of numbers in the 13th century that has left a lasting impact on both mathematics and nature. His work in Liber Abaci laid the foundation for what we now call Fibonacci ratios, which are used across various fields, including trading.

The Fibonacci sequence starts with the numbers 0 and 1, with each subsequent number being the sum of the two previous ones. This simple yet profound sequence appears throughout nature, from the arrangement of leaves and flower petals to the spirals found in seashells and pinecones. These natural patterns highlight the deep connection between mathematics and the world around us.

In financial markets, traders began applying Fibonacci ratios to identify important price levels. The most commonly used ratios—23.6%, 38.2%, and 61.8%, often referred to as the golden ratio—help traders predict market behavior by indicating potential points of price retracement or extension. These ratios have become essential tools for developing strategies and anticipating price movements, giving traders a structured, data-driven approach to market analysis.

Using Fibonacci Levels To Improve Your Trading Strategy

Incorporating Fibonacci levels into your trading strategy can enhance your decision-making by providing key insights into price movements. The process begins by identifying a significant price change, such as a peak or trough on a chart. This movement becomes the reference point for applying Fibonacci analysis.

Once you’ve marked these critical points, measure the distance between them to create a baseline for your calculations. Afterward, apply the Fibonacci ratios—23.6%, 38.2%, 50%, 61.8%, and sometimes 78.6%—to the distance you’ve measured. These percentages help highlight potential support and resistance levels in the market.

To fine-tune your analysis, add or subtract the calculated values from the initial swing point, depending on whether the trend is moving upward or downward. This technique allows you to identify areas where price corrections may occur, offering valuable insight for making well-informed trading decisions.

Common Pitfalls When Using The Abc pattern .328 1.27 with .328 and 1.27 Fibonacci Levels

The Abc pattern .328 1.27, combined with Fibonacci levels like .328 and 1.27, can be a useful strategy for traders, but there are common mistakes that can reduce its effectiveness.

One key error is ignoring the overall market environment. The Abc pattern .328 1.27 should not be used on its own. It works best when analyzed in conjunction with broader market trends, news, and trading volume. Focusing only on the pattern without considering these factors can lead to flawed decisions.

Another frequent mistake is failing to set stop losses. In volatile markets, not setting a stop loss below Point C can expose traders to significant losses in the event of a sudden market reversal. Stop losses are crucial to protecting trades from unforeseen market shifts.

Misinterpreting Fibonacci levels is another common issue. Inaccurate identification of the .328 retracement or 1.27 extension levels can lead to poor trade execution. It’s essential to use reliable tools for determining these Fibonacci levels and double-check your chart analysis before making any moves.

To improve your trading strategy, it’s also recommended to backtest the Abc pattern .328 1.27 to see how effective it has been historically. Additionally, combining the pattern with other technical indicators can help validate signals, increasing the overall accuracy of your trades. By recognizing and avoiding these common errors, traders can better navigate the challenges of the market.

Understanding The .328 and 1.27 Fibonacci Levels In The Abc pattern .328 1.27

The Fibonacci levels .328 and 1.27 play crucial roles within the Abc pattern .328 1.27 and can provide valuable insights into potential market movements.

The .328 retracement level (32.8%) is typically considered a key support point during Wave B of the Abc pattern .328 1.27. When the price retraces to this level, it suggests that the market may be preparing for the continuation of the trend after the correction in Wave B. This level often signals that traders are regrouping, setting the stage for further movement in the direction of the primary trend.

The 1.27 extension level (127%) is often used to forecast the potential endpoint for Wave C. If Wave C reaches this level, it indicates strong momentum, which could either confirm the continuation of the trend or signal a reversal. Traders should pay close attention when the price approaches the 1.27 level, as it can represent a critical decision point.

By integrating these Fibonacci levels into their analysis, traders can refine their understanding of the Abc pattern .328 1.27 and make more informed decisions, gaining an edge in predicting market behavior.

Practical Uses Of Fibonacci Ratios In Trading

Fibonacci ratios are widely used in trading due to their ability to highlight potential price movements. These ratios often act as markers for key support and resistance areas in a market.

When reviewing price charts, traders rely on Fibonacci retracement levels to anticipate where the market might change direction. If the price approaches these critical areas, traders may choose to open a position in hopes of capitalizing on a price rebound.

In addition, Fibonacci extensions are utilized to predict future price targets after a major price move. By employing these extensions, traders can more effectively plan where to take profits and adjust their strategies accordingly.

Pairing Fibonacci ratios with other technical analysis tools enhances decision-making. For instance, using them alongside moving averages or momentum indicators helps traders confirm entry and exit points, increasing their confidence in market analysis.

Using multiple time frames can add depth to your analysis. Short-term traders can benefit from quicker adjustments, while long-term traders gain clearer insights into broader trends by using Fibonacci levels across different time horizons.

Tips For Effectively Using Fibonacci Ratios In Trading

Knowing Fibonacci ratios is only part of the process; applying them successfully requires integrating them into a broader trading plan.

Start by identifying key support and resistance areas, as these are often where price shifts happen, making Fibonacci retracement levels especially useful.

It’s important to remain aware of market trends. When a trend aligns with a Fibonacci level, it increases the likelihood of a continuation or reversal at that level.

Enhance your analysis by combining Fibonacci ratios with other tools such as moving averages or volume indicators. This comprehensive approach helps validate your decisions regarding when to enter or exit a trade.

Patience is also crucial—timing matters in trading. Wait for clear signals that align with Fibonacci levels before making a move.

Finally, track your historical trades involving Fibonacci ratios. Reviewing past performance will offer valuable insights, helping refine your approach and improve future trading decisions.

The .328 1.27 Fibonacci Setup

The “.328 1.27” configuration represents key Fibonacci retracement and extension levels, commonly used within the ABC trading pattern:

- 0.328 (32.8%): This level often acts as a critical retracement point for Wave B. When prices retrace to this level, it typically signals the potential for the trend to continue after the completion of Wave B.

- 1.27 (127%): This level helps forecast the possible endpoint for Wave C. When Wave C surpasses Wave A and hits the 1.27 extension, it suggests strong momentum and could indicate either a trend continuation or a possible reversal.

How To Apply the .328 1.27 Setup In Trading

Traders use this configuration to improve their trading strategies. Here’s how the approach works:

- Identifying the Abc pattern .328 1.27: First, traders need to spot the Abc pattern .328 1.27 on their charts, focusing on key highs and lows that form Waves A, B, and C.

- Measuring Wave B Retracement: After identifying Wave A, traders measure the retracement to the 0.328 level. If the price stays above this level, it can strengthen the case for a bullish continuation of the trend.

- Projecting Wave C: Once Wave B is complete, traders project the length of Wave C using the 1.27 Fibonacci extension. A break beyond the high of Wave A in an uptrend or below the low of Wave A in a downtrend can confirm the pattern’s accuracy.

- Implementing Risk Management: Like any trading method, risk management is key. Traders often place stop-loss orders just beyond key retracement or extension levels to safeguard against unexpected price movements.

By incorporating the .328 and 1.27 levels into their analysis, traders can fine-tune their entry and exit strategies, making more informed decisions in volatile markets.

Example Of Using The Abc pattern .328 1.27 With .328 and 1.27 Fibonacci Levels

Consider a stock that starts in an upward trend, moving from $50 to $100, forming Leg A. Afterward, the stock retraces by about 38.2%, pulling back to $80 (Leg B). Now, using the Fibonacci extension tool, traders would anticipate the next leg, Leg C, to reach the 1.27 extension level. In this example, the 1.27 extension projects a target price of $110 for Leg C, based on the initial movement in Leg A. The following table illustrates this:

| Leg | Price Movement | Description |

| A | $50 → $100 | Initial uptrend |

| B | $100 → $80 | 38.2% retracement |

| C | $80 → $110 | 1.27 extension target |

This simple scenario shows how traders use the Abc pattern .328 1.27 with Fibonacci ratios to estimate future price moves and develop trading strategies.

Steps To Trade Using The Abc pattern .328 1.27

Trading the Abc pattern .328 1.27 requires a systematic approach and careful timing. Here’s a step-by-step guide on how to use the .328 and 1.27 Fibonacci levels within the Abc pattern .328 1.27:

- Identify Leg A: Look for a strong price movement that forms the first leg of the pattern.

- Monitor Leg B: After the completion of Leg A, wait for a retracement. The price should pull back to the 38.2% Fibonacci level to confirm Leg B.

- Project Leg C: Once Leg B is established, use the Fibonacci extension tool to forecast the target for Leg C. The 1.27 extension will provide a potential exit point.

- Set Entry and Exit Points: Enter the trade at the end of Leg B, with a stop-loss placed just beyond the starting point of Leg A. The price target is set at the 1.27 Fibonacci extension, marking the projected end of Leg C.

Real-Life Application: A Trader’s Success With The Abc pattern .328 1.27

Take the example of a swing trader named John, who used the Abc pattern .328 1.27 to guide his trades. John observed a bullish trend in a stock, where the price climbed from $120 to $180, forming Leg A. He waited for a retracement and saw the stock pull back to $150, which aligned with a 38.2% retracement, confirming Leg B.

Using the Fibonacci extension, John predicted the stock would reach the 1.27 extension, projecting a target of $190 for Leg C. John entered his position at $155, slightly above the retracement level, and placed a stop-loss at $140, just below the start of Leg A. Over the next several days, the stock advanced and hit his target price of $190. This resulted in a profitable trade, netting John a gain of $35 per share.

John’s success illustrates the importance of patience, precise analysis, and well-timed entries when using the Abc pattern .328 1.27. By waiting for confirmation of Leg B and utilizing Fibonacci extensions to set realistic targets, traders can boost their chances of successful trades.

FAQs

Q. What is the Abc pattern .328 1.27?

The Abc pattern .328 1.27 is a price action-based trading pattern that helps traders predict market reversals and continuation points by analyzing three distinct price movements, known as Legs A, B, and C.

Q. What are Fibonacci levels in the Abc pattern .328 1.27?

Fibonacci retracement and extension levels, such as 0.328 and 1.27, are used in the Abc pattern .328 1.27 to determine potential points of retracement (Leg B) and price extension targets (Leg C).

Q. What does the .328 and 1.27 represent in the pattern?

The 0.328 (32.8%) level typically marks a retracement for Leg B, while the 1.27 (127%) extension is used to project the potential target for Leg C.

Q. How do traders use Fibonacci extensions with the Abc pattern .328 1.27?

Traders use Fibonacci extensions to predict where the price might move after completing Leg B. The 1.27 Fibonacci extension provides a target for Leg C, offering a guide for taking profit.

Conclusion

The Abc pattern .328 1.27, combined with the .328 retracement and 1.27 Fibonacci extension levels, offers traders a structured way to identify potential price reversals and extensions. By understanding how to apply these levels, traders can enhance their market predictions, making more informed decisions on entry and exit points. As with any trading strategy, proper analysis, patience, and risk management are key factors for success. Integrating the Abc pattern .328 1.27 with other technical indicators further increases the chances of accurate predictions, creating a robust trading strategy that can adapt to varying market conditions.

Stay in touch with us for more updates and alerts! Ventstribune